Average tax rate calculator

There is a statewide sales tax and each county levies an additional tax. For example if a household has a total income of.

What Are Marriage Penalties And Bonuses Tax Policy Center

That means that your net pay will be 43041 per year or 3587 per month.

. At higher incomes many deductions and many credits are phased. Our income tax calculator calculates your federal state and local taxes based on several key inputs. This calculator helps you estimate your average tax.

Additionally some counties also collect their own sales taxes of up to 15 which means that actual rates paid in. Marginal tax rate 633. Your income puts you in the 10 tax bracket.

Using the 2021 standard deduction would put your total estimated taxable income at 35250 60350 - 25100 placing you in the 12 tax bracket for your top dollars. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. 100 Accurate Calculations Guaranteed.

Calculate the tax savings. The average tax rate is the total amount of tax divided by total income. This is 0 of your total income of 0.

Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. Your income puts you in the 10 tax bracket. Personal tax calculator.

10 12 22 24 32 35 and 37. At higher incomes many deductions and many credits are phased. Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today.

Your income puts you in the 10 tax bracket. These are the rates for. New York state tax 3925.

This is 0 of your total income of 0. The statewide sales tax rate in Florida is 6. There are seven federal tax brackets for the 2021 tax year.

How do you calculate average tax rate example. As this calculator shows even if taxable income puts you in a particular income tax bracket overall you benefit from being taxed at the lower brackets first. Florida Sales Tax.

Your household income location filing status and number of personal. This is 0 of your total income of 0. Find your total tax as a percentage of your taxable income.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules. Total income tax -12312.

0 would also be your average tax rate. If you make 55000 a year living in the region of New York USA you will be taxed 11959. The 38 Medicare tax will apply to the lesser of your net investment income or the amount of adjusted gross income in excess of the applicable threshold.

At higher incomes many deductions and many credits are phased. Calculate your combined federal and provincial tax bill in each province and territory. 0 would also be your average tax rate.

Your bracket depends on your taxable income and filing status. Ad Try Our Free And Simple Tax Refund Calculator. The average effective property tax rate for the state is below the national average.

Effective tax rate 561. 0 would also be your average tax rate.

:max_bytes(150000):strip_icc()/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

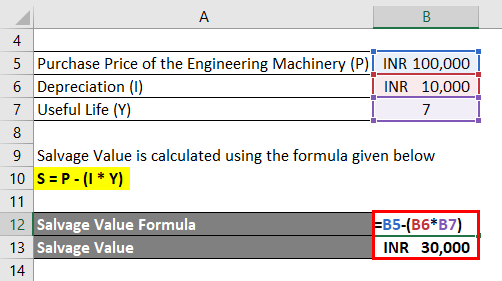

Salvage Value Formula Calculator Excel Template

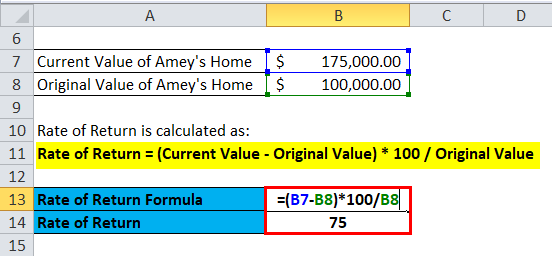

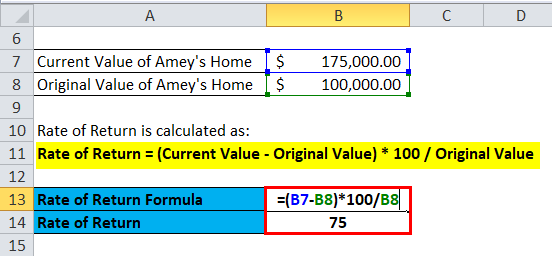

Rate Of Return Formula Calculator Excel Template

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Discount Factor Formula And Calculator Excel Template

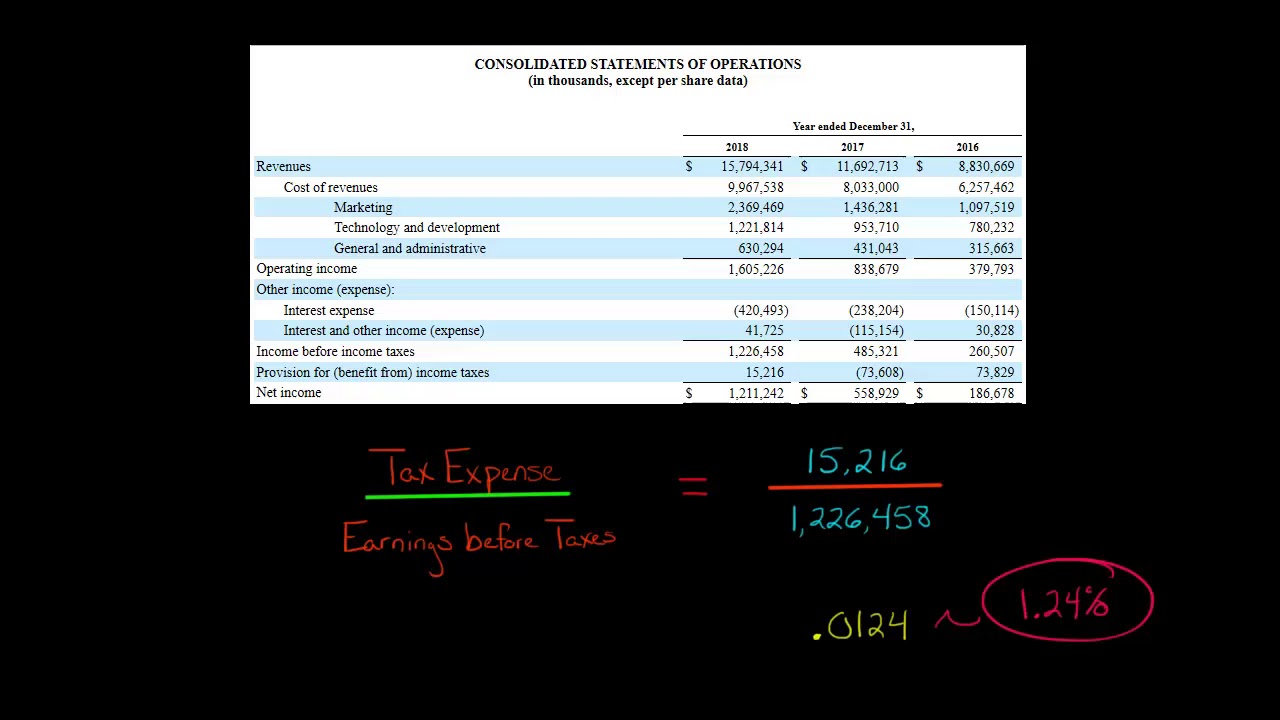

Marginal And Average Tax Rates Example Calculation Youtube

:max_bytes(150000):strip_icc()/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg)

Formula For Calculating Net Present Value Npv In Excel

Average Revenue Per User Arpu Formula And Calculator Excel Template

Salvage Value Formula Calculator Excel Template

Effective Tax Rate Formula Calculator Excel Template

How To Calculate The Effective Tax Rate Youtube

Federal Income Tax Calculating Average And Marginal Tax Rates Youtube

Marginal Tax Rate Formula Definition Investinganswers

Apy Calculator

Excel Formula Income Tax Bracket Calculation Exceljet

Salvage Value Formula Calculator Excel Template

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition