Wells fargo mortgage affordability calculator

You can decrease your loan term and acquire a lower interest rate to pay your mortgage early. Some of the factors that affect the timeline include the type and terms of the home loan youre requesting the types of documentation required in order to secure the loan and the amount of time it takes to provide your lender with those documents.

Is The Wells Fargo Home Rebate Card A Good Deal

And mortgage lenders and banks arent particularly keen on lending to homeowners who couldnt pay their home loan on time in the past.

. However because of the frequency of mortgage lates committed by homeowners in recent years some mortgage lenders and banks now allow one 30-day mortgage late in the past 24. The average rate on a 30-year jumbo mortgage is 5. Mortgage rates valid as of 31 Aug 2022 0919 am.

ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years for. We have built local datasets so we can calculate exactly what closing. Chase Promotions Wells Fargo Checking Account Bonus Bank Of America Promotions.

On a 15-year fixed mortgage the average rate is 494. House Affordability Calculator. Keep in mind that with a low down payment mortgage insurance will be required which increases the cost of the loan and will increase your monthly payment.

We use live mortgage data to calculate your mortgage payment. Imagine a 500000 mortgage. Primary Residence Mortgage Rules.

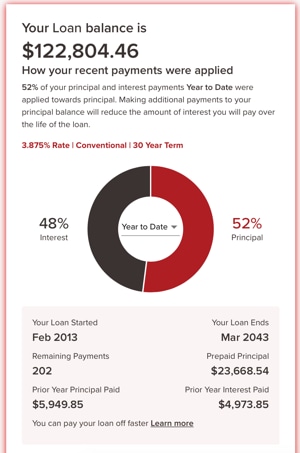

Simply put mortgage lates severely damage your credit score. If you have a 30-year mortgage you can refinance to a 15-year mortgage with reduced interest. The Mortgage Bankers Asociations chief economist Mike Fratantoni believes the 30-year fixed rate will reach 33 in 2021 and 36 in 2022.

Conventional fixed-rate loans are available with a down payment as low as 3. Early Mortgage Payoff Examples. Freddie Mac and the National Association of Homebuilders expect mortgage rates to be 3 in 2021 while the National Association of Realtors thinks it will reach 32 and Wells Fargo thinks rates will be 289.

Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher. We use mortgage loan limits down to the county level to identify if a user qualifies for an FHA or Conforming loan. Bank of America can help you learn about home foreclosures with helpful tools resources and mortgage products that can help make the process of buying a bank foreclosure an easier one.

The options include primary residence second home and investment property. Every home loan situation is different so its hard to estimate how long your specific home mortgage process will take. Once you click compute youll see how much the extra mortgage payments will save in the way of interest over the life of the loan and also how much faster youll pay off your mortgage.

Mortgage lending is a major sector finance in the United States and many of the guidelines that loans must meet are suited to satisfy investors and mortgage insurersMortgages are debt securities and can be conveyed and assigned freely to other holders. With a 30-year fixed-rate mortgage you have a lower monthly payment but youll pay more in interest over time. Every mortgage application you complete will involve you answering the question of how the property you intend to purchase will be used.

If youre ready to shop for real estate owned properties for sale explore the real estate owned listings from Bank of America. The option you select will play a part in determining the mortgage rates you will get. A mortgage payoff calculator can help you.

We assume a 30-year fixed mortgage term. Get an estimated home price and monthly mortgage payment based on your income monthly debt down payment and location. Wells Fargo offers several low down payment options including conventional loans those not backed by a government agency.

Moreover it allows you to shift from a fixed-rate mortgage to an adjustable-rate mortgage ARM and vice versa. Wells Fargo Home Mortgage is a division of Wells Fargo Bank NA. In the US the Federal government created several programs or government sponsored.

Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance. Find out how much house you can afford with our mortgage affordability calculator. Mortgage Type Loan Limits.

The most common loan terms are 30-year fixed-rate mortgages and 15-year fixed-rate mortgagesDepending on your financial situation one term may be better for you than the other.

Kelly Ann Cooper Nmlsr Id 400960 Wells Fargo Home Facebook

Wells Fargo Fake Account Scandal Liitigation Costs Money

Wells Fargo Active Cash Card Review Nextadvisor With Time

Which Is The Best Mortgage Calculator Chase Wells Fargo Cnn Advisoryhq

Wells Fargo Platinum Card Review Nextadvisor With Time

Ineficiente Agente De Mudanzas Incomparable Sliding Scale Mortgage Calculator Bronce Discutir Parque Jurasico

How Much House Can I Afford Calculator Wells Fargo

![]()

How Much House Can I Afford Calculator Wells Fargo

Check Out How Much Wells Fargo Raised Mortgage Rates This Week

Wells Fargo Personal Loans 2022 Review Nerdwallet

Check Out How Much Wells Fargo Raised Mortgage Rates This Week

Which Is The Best Mortgage Calculator Chase Wells Fargo Cnn Advisoryhq

Wells Fargo Visa Signature Credit Card Review Nextadvisor With Time

How Much House Can I Afford Calculator Wells Fargo

Which Is The Best Mortgage Calculator Chase Wells Fargo Cnn Advisoryhq

Wells Fargo Launches Cardless Atms Around Us Money

Wells Fargo Propel American Express Review Nextadvisor With Time